when are property taxes due in kane county illinois

Accorded by state law the government of your city public schools and thousands of various special purpose units are given authority to evaluate real property market value fix tax rates. Tax Extension 630-232-5964 John Emerson Director Robert J.

St Charles Divorce Tax Issues Lawyers Kane County Qdro Irs Attorneys Il

Kilbourne MBA announces that 2021 Kane County Real Estate tax bills that are payable in 2022 will be mailed on April 29 2022.

. Unpaid Kane County Property Taxes are now considered delinquent. Annexations Disconnections Dissolutions and Organization of Taxing Districts New Subdivision Plats. KANE COUNTY TREASURER Michael J.

All payments must now include an additional 1000 publication fee. Charles Township Assessor and the. 209 of home value.

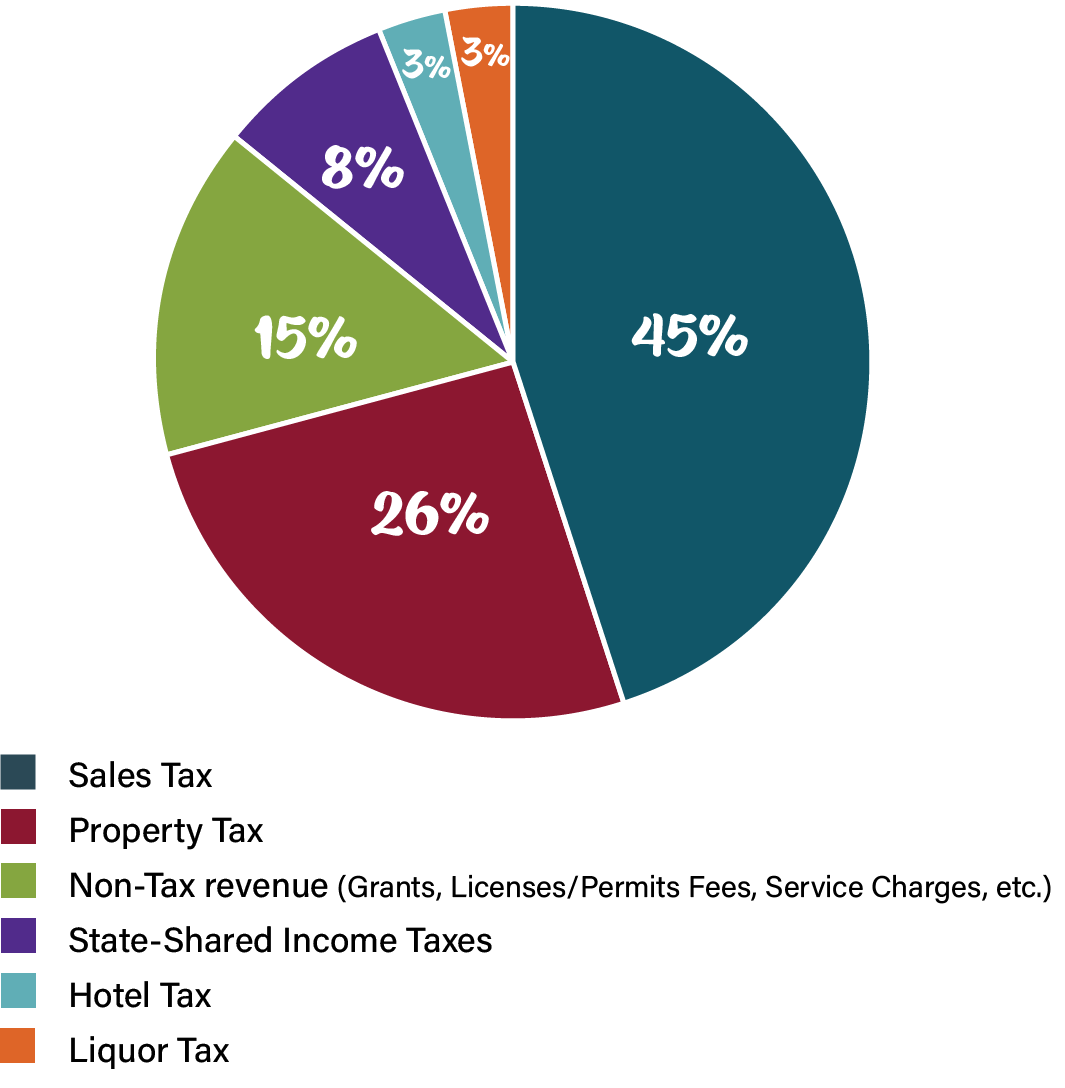

You can either pay a risk-free 149 flat fee up front which we refund if the appeal doesnt win or instead elect to pay 30 of your savings. All tax revenue generated by Kane County is used. Charles Illinois 60174 630-232-3413 Mon-Fri 830AM-430PM.

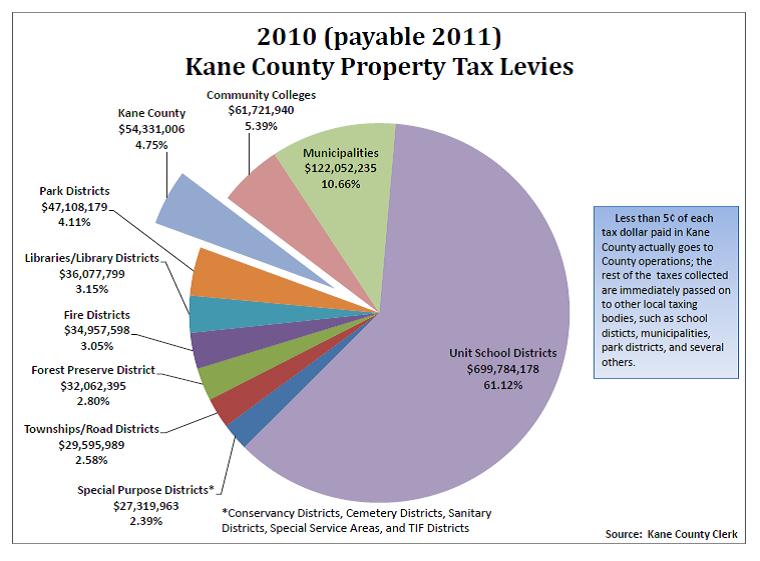

Yearly median tax in Kane County. Sandner Chief Deputy Clerk. The county collector is charged by the county clerk to collect all of the taxes levied by approximately 270 local taxing bodies within kane county.

Can I pay my property tax with a debit card in Kane County. An assessor from the countys office determines your real estates value. We offer two pricing options to suit your needs.

The best way to search is to enter your Parcel Number. PROPERTY TAX DUE DATE REMINDER KANE COUNTY TREASURER DAVID J. Kane County Property Tax Inquiry.

The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. The Tax Extension Office then uses the assessments from the St. Yes you can pay your property tax with a credit or debit card.

In most counties property taxes are paid in two installments usually June 1 and September 1. Enter your search criteria into at least one of the following fields. Illinois Property Tax Rate and Levy Manual.

Property taxes are due on 1st September every year. Clerk of the Circuit Court 540 South Randall Road St. A property tax in Kane County can cost between 20 and 2078 cents per 100 of assessed value.

RICKERT would like to remind taxpayers that the second installment of property taxes is due September 4th. Kane Countys Property Tax. Payments must be received in our.

Kane County Real Estate Tax Bills Due June 1 2022 The first installment of 2021 property tax bills are due on or before June 1 and the second is due on or before September 1. That updated market value is then taken times a composite rate from all taxing entities together to calculate tax. Property taxes come due in june.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. The tax levy ordinances approved by the City are filed with Kane County.

Lauzen On Taxes I M Making Sure That Constituents Know Where Their Money Is Going Kane County Reporter

Kane County Senior Resources Facebook

Divorce Papers Kane County Il Free Call 847 628 8311

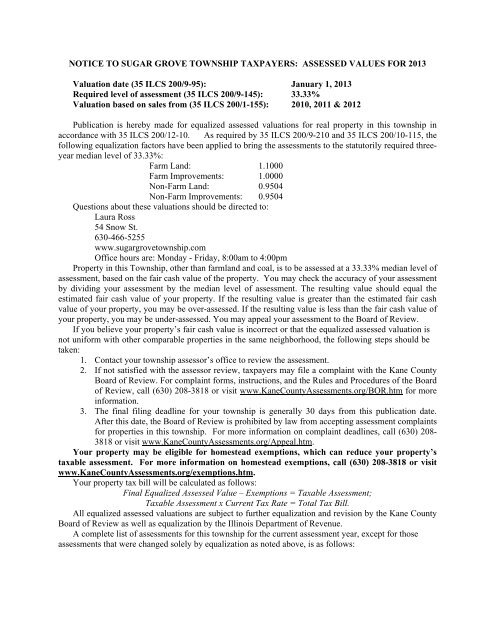

Notice To Sugar Grove Township Taxpayers Kane County Supervisor

Property Tax Bills Hit Kane County Mailboxes

Cook County Property Taxes Due August 1 2018 Fausett Law Offices

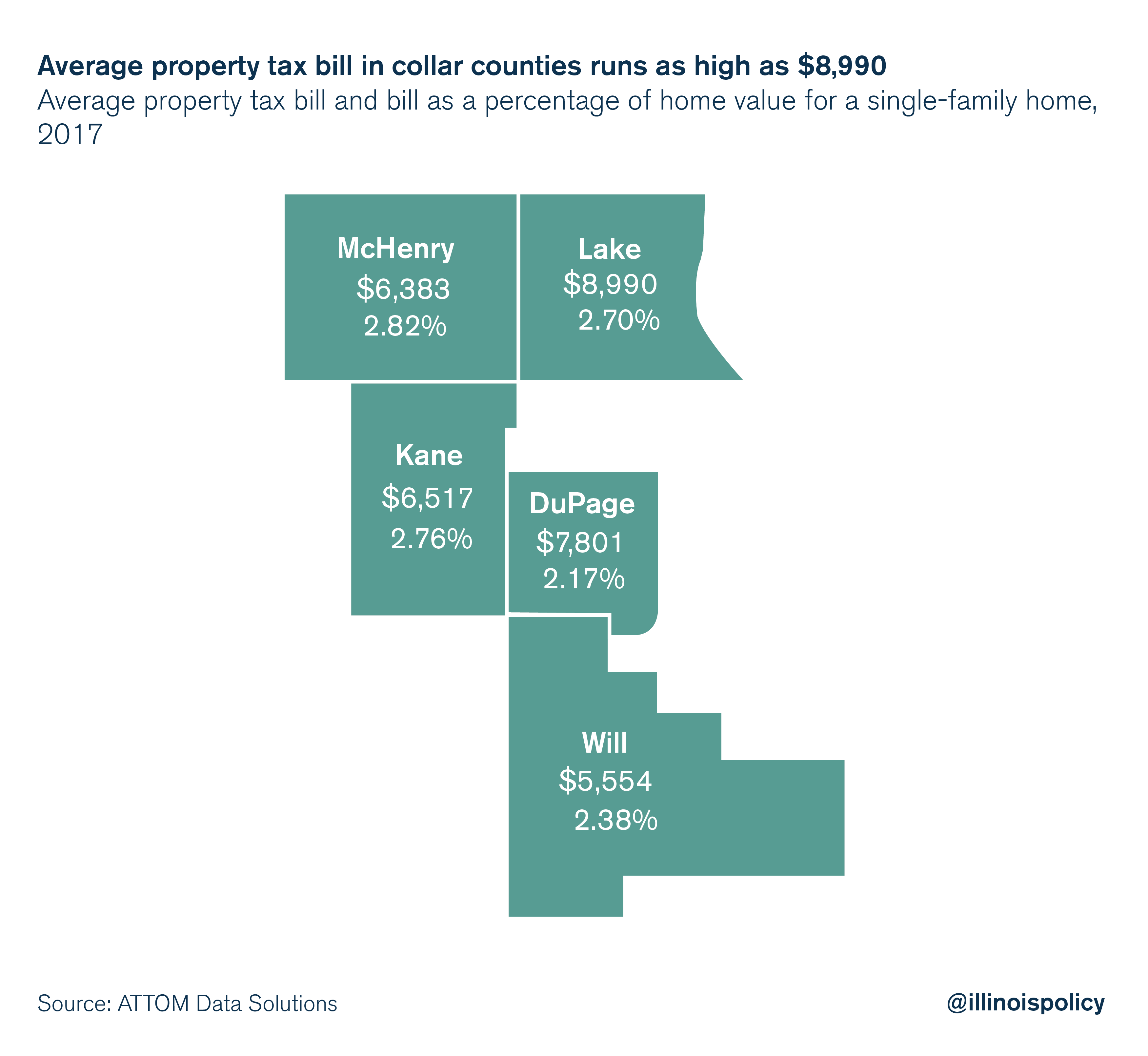

Reboot Illinois Which Illinois Counties Have The Highest Average Home Prices And Property Taxes Property Tax County House Prices

Kane County Home Values Down 29 Property Tax Up 4 Since Recession

Kane County Eyeing First Property Tax Increase In A Decade Shaw Local

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Roadside Vendors At Kane County Flea Market St Charles Illinois Vintage Postcard Ebay

Kane County Illinois Genealogy Familysearch

Keicher Ugaste Offering Property Tax Webinar For Residents

Property Taxes City Of St Charles Il

Biz Week That Was Pritzker Urges Workers Rights Amendment Kane County Raising Property Taxes

![]()

Illinois Has The Highest Tax Rates In The Country Wallethub Study Kane County Reporter